accumulated earnings tax calculation example

Instead they are retained to be reinvested in a new business opportunity to increase inventory levels to lower long-term debt or to increase cash reserves. It required the parties to compute the new tax liability based on the corporations holdings under the courts rule 155.

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

X has been a profitable.

. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation. Divide the current year earnings and profits 10000 by the total amount of distributions made during the year 16000. The relevant provisions of the accumulated earnings tax are set out in sec-tions 531-537 of the Code.

REASONABLE NEEDS OF THE BUSINESS. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the. This tax evolved as shareholders began electing to have companies retain earnings rather than pay them out as dividends in an effort to avoid.

200000 - 50000 - 5000 145000 This amount will be carried over to the new accounting period and can be used to reinvest into the business or to pay future dividends. The accumulated earnings of a firm are profits generated but not distributed to the shareholders as cash dividends or as corporate profit taxes. A computation of earnings and profits for the tax year see the example of a filled-in worksheet and a blank worksheet below.

Accumulated EP on January. The threshold is 25000 without accumulated earning tax. In deciding whether the penalty tax should be im-posed the key question is whether the corporation was in the language of section 532 formed or availed of for the purpose of avoiding the income tax with respect.

When the revenues or profits are above this level the firm will be subjected to accumulated earnings tax if they do not distribute the dividends to shareholders. Accumulated EP on January. For example the receipt of a 100 portfolio dividend would be reflected in taxable income only to the extent of 30 100 dividend income less a 70 dividends-received deduction but EP must be increased by the 70 dividends-received deduction amount to accurately reflect that the company has a full 100 economic accession to wealth.

The parties disagreed on the correct tax computation and instituted the current case to determine the right amount. The tax is assessed by the IRS rather than self-assessed. The dividends paid to shareholders of preferred and common stocks amount to 2725 million.

Accumulated earnings and profits EP are net profits a company has available after paying dividends. Calculation of EP. The accumulated earnings tax may be imposed on a corporation for a tax year if it is determined that the corporation has attempted.

The Accumulated Earnings Tax is more like a penalty since it is assessed by the IRS often years after the income tax return was filed. It is presumed that a corporation can retain up to 25000000 or 15000000 for certain service corporations for. Calculating the Accumulated Earnings Tax.

The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue Code. The accumulated earnings tax is considered a penalty tax to those C corporations that have accumulated over 250000 in earnings 150000 for PSC corporations and if that excess amount has not been distributed to shareholders in the form of a dividend. Accumulated Earnings Calculation Example.

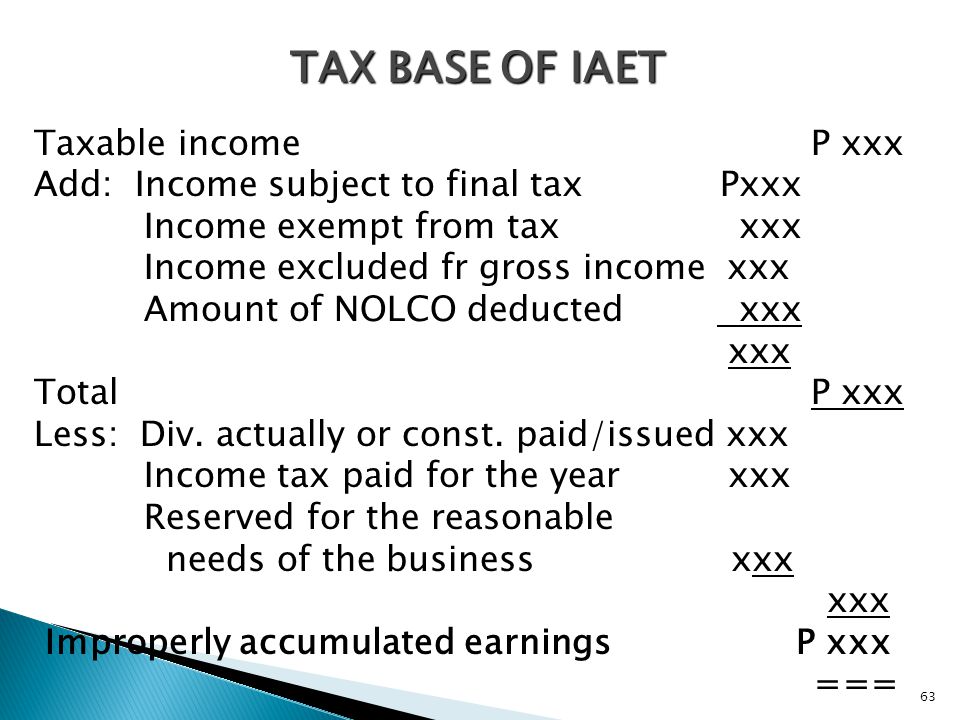

The Accumulated Earnings Tax is. The Accumulated Earnings Tax is computed by multiplying the Accumulated Taxable Income IRC Section 535 by 20. Accumulated Earnings Tax can be reduced by reducing Accumulated Taxable Income.

Accumulated earnings and profits are less than the. The 290k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of New Mexico is used for calculating state taxes due. The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income.

Next a corporation should determine how it will use any earnings accumulated in excess of its working capital needs. Breaking Down Accumulated Earnings Tax. The table below provides.

It compensates for taxes which cannot be levied on dividends. Lets start our review of the 29000000 Salary example with a simple overview of income tax deductions and other payroll deductions for 2022. All groups and messages.

Multiply each 4000 distribution by the 0625 figured in 1 to get the amount 2500 of each distribution treated as a distribution of current year earnings and profits. The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and foreign income taxes. There is a certain level in which the number of earnings of C corporations can get.

The base for the accumulated earnings penalty is accumulated taxable income. The tax is assessed at the highest individual tax rate on the corporations accumulated income and is in addition to the regular corporate income tax. This is because the accumulated earnings tax is directed at regular corporations who hold an excess of retained earnings instead of being distributed as dividends to shareholders.

If the corporation was required to complete Schedule M-1 Form 1120 or Schedule M-3 Form 1120 for the tax year also attach. The formula for the companys accumulated earnings for the end of the year would be. On a personal level the accumulated.

22500000 Tax depreciation. IRC Section 535c1 provides that. The result is 0625.

The rate for the accumulated earnings tax is the same as the rate individual taxpayers pay on dividends or 20. This figure is calculated as EP at. Automate Accumulated Profit with Accounting Software.

The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. 8 rows Example. Calculating the Accumulated Earnings RE Initial RE net income dividends.

For example lets assume a certain company has 100000 in accumulated. Up to 10 cash back 21. The company pays the.

Adjustments to this calculation or other methods may be appropriate. When the net profits of a company increase the accumulated earnings also increase.

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Demystifying Irc Section 965 Math The Cpa Journal

Earnings And Profits Computation Case Study

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

What Are Earnings After Tax Bdc Ca

Earnings And Profits Computation Case Study

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Determining The Taxability Of S Corporation Distributions Part I

What Are Retained Earnings Bdc Ca

Demystifying Irc Section 965 Math The Cpa Journal

What Are Accumulated Earnings Definition Meaning Example

Demystifying Irc Section 965 Math The Cpa Journal

Demystifying Irc Section 965 Math The Cpa Journal

Earnings And Profits Computation Case Study

Determining The Taxability Of S Corporation Distributions Part Ii

Retained Earnings Formula And Excel Calculator

Demystifying Irc Section 965 Math The Cpa Journal

Determining The Taxability Of S Corporation Distributions Part Ii